Is Tech Making learn stock trading Better or Worse?

Countless novices attempt their hand at the market casino each year, but the majority of stroll away a little poorer and a lot better, never reaching their full capacity. Most of those who stop working have one thing in common - They haven't mastered the standard abilities required to tilt the chances in their favor. However, if one takes the adequate time to learn them then they will be well on their way to increasing their odds of success.

World markets bring in speculative capital like moths to a flame, with most throwing cash at securities without understanding why prices move higher or lower. Instead, they chase hot suggestions, make binary bets and sit at the feet of masters, letting them make buy and sell choices that make no sense. A much better path is to discover how to trade the marketplaces with skill and authority.

Start with a self-examination that takes a close look at your relationship with cash. Do you view life as a battle, with tough effort required to make each dollar? Do you think charisma will attract market wealth to you in the same method it carries out in other life pursuits? More ominously, have you lost money regularly through other activities and hope the financial markets will treat you more kindly?

Whatever your belief system, the marketplace is likely to strengthen that internal view over and over again through earnings and losses. Tough work and charm both support financial success, however losers in other walks of life are most likely to become losers in the trading game. Do not worry if this sounds like you. Instead, take the self-help path and learn about the relationship between money and self-respect.

As soon as you get your head on straight, you can embark on finding out trading, starting with these 5 fundamental steps.

1. Open a Trading Account

Sorry if it appears we're mentioning the apparent, however you never ever understand (keep in mind the person who did everything to establish his brand-new computer system-- Visit this page except to plug it in). Find an excellent online stock broker and open a stock brokerage account. Even if you currently have a personal account, it's not a bad idea to keep a professional trading account different. End up being acquainted with the account interface and make the most of the free trading tools and research study offered specifically to customers. A variety of brokers use virtual trading (more on that in action 5). Investopedia has the very best Online Brokers Awards with evaluations to help you find the ideal broker.

2. Learn to Check Out: A Market Crash Course

Financial short articles. Stock market books. Site tutorials. There's a wealth of information out there, much of it affordable to tap. And do not focus too directly on one single element of the trading game. Instead, research study everything market-wise, consisting of concepts and concepts you do not feel are particularly pertinent at this time. Trading releases a journey that frequently winds up at a location not anticipated at the starting line. Your broad and in-depth market background will be available in helpful over and over once again, even if you believe you understand precisely where you're going right now.

Here are 5 must-read books for every single new trader:

Stock Exchange Wizards by Jack D. Schwager1.

Trading for a Living by Dr. Alexander Elder2.

Technical Analysis of the Financial Markets by John Murphy3.

Winning on Wall Street by Martin Zweig4.

The Nature of Risk by Justin Mamus5.

Start to follow the market every day in your extra time. Get up early and read about over night cost action on foreign markets. (U.S. traders didn't have to keep an eye on worldwide markets a couple of decades back, but that's all altered due to the quick growth of electronic trading and acquired instruments that connect equity, forex and bond markets worldwide.).

News sites such as Yahoo Financing, Google Financing and CBS MoneyWatch act as an excellent resource for brand-new financiers. For more sophisticated coverage, you require look no even more than The Wall Street Journal, Bloomberg and, well, us at Investopedia.com.

3. Learn to Analyze.

Research study the basics of technical analysis and look at rate charts, thousands of them, in all amount of time. You might believe fundamental analysis offers a better course to profits since it tracks growth curves and revenue streams, however traders live and die by rate action that diverges dramatically from underlying principles. Do not stop reading business spreadsheets, due to the fact that they offer a trading edge over those who neglect them. Nevertheless, they will not assist you survive your very first year as a trader.

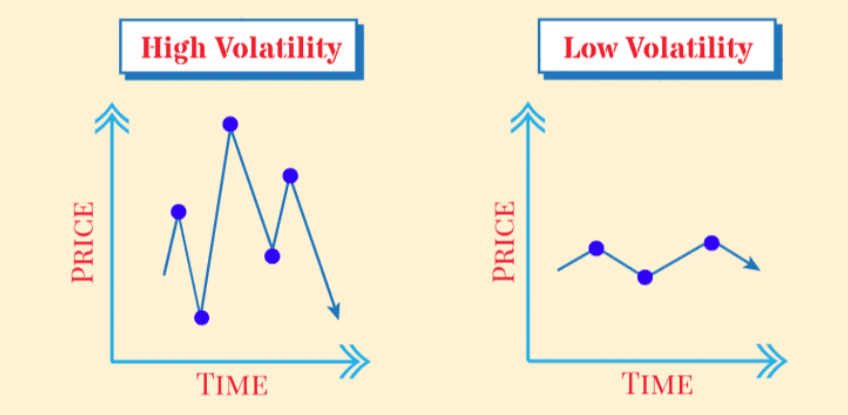

Your experience with charts and technical analysis now brings you into the wonderful realm of cost forecast. In theory, securities can just go higher or lower, encouraging a long-side trade or a short sale. In truth, costs can do numerous other things, consisting of slicing sideways for weeks at a time or whipsawing violently in both directions, shaking out buyers and sellers.

The time horizon becomes extremely important at this juncture. Monetary markets grind out patterns and trading ranges with fractal residential or commercial properties that produce independent cost motions at short-term, intermediate-term and long-lasting periods. This suggests a security or index can take a long-term uptrend, intermediate sag and a short-term trading variety, all at the very same time. Instead of complicate forecast, many trading chances will unfold through interactions in between these time periods.

Buying the dip provides a classic example, with traders leaping into a strong uptrend when it sells in a lower duration. The finest way to examine this three-dimensional playing field is to look at each security in three time frames, starting with 60-minute, daily and weekly charts.

4. Practice Trading.

It's now time to get your feet damp without offering up your trading stake. Paper trading, aka virtual trading, uses a best option, allowing the neophyte to follow real-time market actions, making purchasing and selling choices that form the summary of a theoretical efficiency record. It normally includes making use of a stock exchange simulator that has the look and feel of an actual stock exchange's efficiency. Make great deals of trades, using different holding durations and methods, and after that evaluate the results for obvious flaws.

Investopedia has a free stock exchange video game, and many brokers let customers engage in paper trading with their real money entry systems, too. This has actually the included advantage of teaching the software so you do not strike the wrong buttons when you are having fun with household funds.

So, when do you make the switch and start trading with genuine cash? There's no perfect answer due to the fact that simulated trading brings a flaw that's most likely to appear whenever you start to trade for genuine, even if your paper results appearance perfect.

Traders require to co-exist in harmony with the twin feelings of greed and worry. Paper trading does not engage these emotions, which can only be experienced by actual revenue and loss. In truth, this psychological element forces more first-year players out of the video game than bad decision-making. Your baby actions forward as a brand-new trader need to acknowledge this difficulty and address remaining issues with cash and self-regard.

5. Other Ways to Learn and Practice Trading.

While experience is a great instructor, don't forget about additional education as you continue on your trading career. Whether online or in person, classes can be beneficial, and you can find them at levels varying from beginner (with suggestions on how to evaluate the abovementioned analytic charts, for instance) to pro. More customized workshops-- often performed by a professional trader-- can provide valuable insight into the overall market and particular financial investment strategies. A lot of concentrate on a particular type of property, a specific element of the marketplace, or a trading strategy. Some may be academic, and others more like workshops in which you actively take positions, test out entry and exit strategies, and other workouts (often with a simulator).

Paying for research and analysis can be both academic and useful. Some financiers may find seeing or observing market professionals to be more advantageous than attempting to use newly discovered lessons themselves. There are a slew of paid subscription sites offered across the web: 2 well-respected services consist of Investors.com and Morningstar.

It's likewise helpful to get yourself a mentor-- a hands-on coach to assist you, critique your method and deal recommendations. If you do not understand one, you can buy one. Lots of online trading schools use mentoring as part of their continuing ed programs.

Manage and Flourish.

As soon as up and running with real money, you need to resolve position and risk management. Each position carries a holding duration and technical criteria that favor profit and loss targets, needing your prompt exit when reached. Now consider the psychological and logistical needs when you're holding 3 to five positions at a time, with some relocating your favor while others charge in the opposite instructions. Fortunately, there's plenty of time to find out all elements of trade management, as long as you do not overwhelm yourself with excessive details.